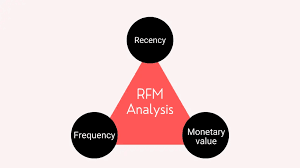

Hey there! If you’re looking to get a deeper understanding of your customers and how to better serve them, RFM analysis is a great place to start. RFM stands for Recency, Frequency, and Monetary value, and it’s a tried-and-true method for customer segmentation. Let’s break down the basics of RFM analysis and explore why it’s so important for segmenting your customers.

What is RFM Analysis?

- Recency (R): This measures how recently a customer has made a purchase. The more recent the purchase, the higher the recency score. Customers who’ve bought something recently are more likely to engage again.

- Frequency (F): This looks at how often a customer makes a purchase over a specific period. Frequent buyers are generally more loyal and engaged.

- Monetary (M): This evaluates how much money a customer spends. Higher spending customers are often considered more valuable.

By combining these three metrics, you can gain insights into your customers' purchasing patterns and identify who your most valuable customers are.

Breaking Down the Metrics

- Recency:

- Recency measures the interval between a customer’s last purchase and the present. The logic here is straightforward: customers who have purchased recently are more likely to return than those who haven’t bought anything in a while. For instance, a customer who bought something last week is more engaged than someone who last purchased six months ago.

- Example: Let’s say you own an online clothing store. You might find that customers who bought something within the last month are more likely to respond to new promotions than those who haven't bought anything in the past year.

- Frequency:

- Frequency measures how often a customer makes a purchase within a given timeframe. The more often they buy, the higher their frequency score. This metric helps identify your most loyal customers who keep coming back for more.

- Example: In your online clothing store, you might notice that customers who make multiple purchases in a month are highly engaged and likely to be interested in loyalty programs or exclusive offers.

- Monetary:

- Monetary value measures how much money a customer spends over a specific period. Customers who spend more are generally more valuable to your business. This metric can help you identify high-spending customers who might be worth targeting with premium offers.

- Example: You might find that customers who spend over $500 annually are your most profitable segment, and therefore, you might want to offer them special incentives to maintain their loyalty.

Why RFM Analysis is Important for Customer Segmentation

RFM analysis is crucial because it allows businesses to segment their customers based on their purchasing behavior. This segmentation helps in tailoring marketing strategies to different customer groups, leading to more personalized and effective marketing efforts. Here’s why RFM analysis is so valuable:

- Targeted Marketing:

- By understanding which customers are most engaged, you can tailor your marketing efforts to target these individuals more effectively. For example, you might send recent buyers exclusive offers to encourage repeat purchases.

- Improved Customer Retention:

- Identifying high-frequency and high-monetary customers allows you to focus on retaining your most valuable clients. Implementing loyalty programs and personalized offers for these segments can significantly improve retention rates.

- Resource Allocation:

- RFM analysis helps you allocate your marketing resources more efficiently. Instead of spending equally across all customers, you can invest more in those who are likely to provide the highest return.

- **Enhanced ** Customer Experience :

- By segmenting customers based on their behavior, you can create more personalized experiences. For instance, frequent shoppers might appreciate early access to sales, while high spenders might value premium customer service.

Real-World Application

Let me share a quick story from my time working at a mid-sized online retailer. We used RFM analysis to segment our customer base and discovered that a small group of customers had high recency, frequency, and monetary scores. These customers were incredibly loyal and engaged, but we weren’t doing anything special for them.

Once we identified this group, we started offering them exclusive promotions, early access to new products, and even personal shopping assistants. The results were amazing—our repeat purchase rate shot up, and these high-value customers became even more loyal. Plus, we were able to allocate our marketing budget more effectively by focusing on these key segments.

Wrapping Up

RFM analysis is a powerful tool for understanding your customers and tailoring your marketing strategies accordingly. By focusing on Recency, Frequency, and Monetary value, you can segment your customer base, improve retention, and enhance the overall customer experience.

I hope this helps you get a better grasp of RFM analysis and its importance in customer segmentation. If you have any questions or want to share your own experiences, feel free to reach out. Happy analyzing!